Guest Post: A Gearhead's Guide To Passing For An "Investor"

All readers welcome

(There are few things I value more than original thinking. Pete D. from Contravex does it in Costco bulk. I disagree with him all the time, but he’s rich and I’m not, so draw your own conclusions about who is right — jb)

At the request of "Skinny Jack,"1today we're going to talk about what makes, or doesn't make, an "investor." This is important to clarify, especially for ACFers (Jackolytes?),

(Jackobins, obviously — jb)

because the label "investor" is thrown around a lot by those both within and without the category class, and since such fuzzy thinking is self-evidently gay, let's endeavour today to purify this perplexity... in the waters of Lake Minnetonka.2 What, aside from a twisted sense of humour, makes yours truly qualified to guide you on this semantic tour of investordom? Aside from having made a few savvy bets in his day, quite simply that the big man asked me, and in the decade or so that we've exchanged notes, he hasn't asked me for much... well, other than for a whole friggin' bitcoin... but that was just one time, and I declined anyways. So without further ado! First, in the very broadest sense, let's define an "investor" as a market participant who turns $1 into $2, allocating their capital and intellectual labour to grow or at least preserve their purchasing power over time.

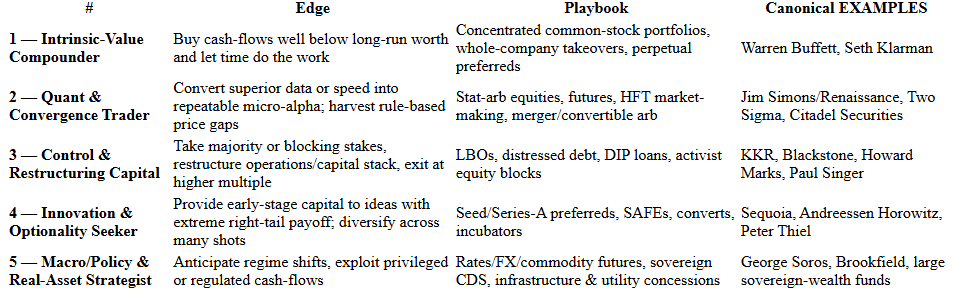

Still with me? Good. Next, let's divide "investors" into 2 primary categories - professional vs. retail - to distinguish those who undertake this pursuit for a living vs. those of us like myself who do it off the corner of our desks. Lastly, and most granularly, let's clarify each of these into 5 further sub-categories representing the various and largely non-overlapping strengths, means, and abilities of these respective types. So here are the top 5 "professional investor" types:

And top 5 "retail investor" types:

Kinda makes sense? Of course then there are also versions of "entrepreneurs" that will mix and match several of the above, but if you, dear ACFers Jackolytes, aspire to join the ranks of any of these, ultimately the trick is to know which kind of investor you are, to seek mastery in that sub-category by aligning your personal temperament, capital base, and edge, all while refusing the siren call to wander outside of that domain.

Having myself been on the retail side for over 25 years, I've found that my personal competency isn't reading boring ass SEC filings all day (à la Buffett), hyping up pre-profit shiny toys (à la Andreessen Horowitz), sucking the last drops of marrow from defunct businesses (à la Paul Singer), or depriving real world engineering firms of America's finest intellect and ambition in order to build micro-cent mirages of liquidity (à la Citadel), but rather in what you might call the "Thales of Miletus"3 modus operandi of spending my days reading history, philosophy, design, technology, and of course way too many car reviews, and then every decade or so noticing severely underpriced options in a market with clearly investible surface areas and relatively high liquidity, and taking that opportunity to "prove" that I'm more than an impractical daydreamer -- that this childhood lego maniac is still pretty respectable at putting the pieces together when the opportunity presents.

All that said, you, dear reader, can hopefully now better appreciate the breadth and depth of the "investor" class, and be clearer-eyed about asking for guidance (or investment) from the right people in the right sub-category. Not that any of us who've "made it" mind the compliment - it always feels good to be considered highly - but our advice is a thousand times more useful when we're actually within our domain of expertise, and don't have to stretch for understandings in domains we have few theories about and even less experience in. So apologies but I don't have an opinion on your social platform for skilled trades, IP arbitrage play, or philosopher chat-bot business, at least not from an "investor" perspective. I seriously don't have a fucking clue. (Sorry Fadi, Dave, and Zohar). But hopefully I can at least point you in the right direction.

So yes, the "investor" world is a big broad space, but it's still comprehensible for most of you, and perhaps even aspirational for some of you. If not, we have a parting gift for you all the same: while I obviously don't know your specific circumstances, Jack dutifully informs me that you're generally bitter, old, and male,

(All of these things, to me, constitute virtues — jb)

so with that in mind, as far as generic investment advice goes, I'd humbly recommend DCAing into Bitcoin if you haven't already - the ETFs will suffice if self-custody is too techy/complicated - or if that's a bridge too far, just buy some physical gold, ideally as much as Costco will sell you.

Of course, this is all just lazy guidance for 99.9% of people and for all I know you're in the 0.1% and have some other edge and inclination to do even better than ~50% / year compounding over the next decade. Nothing wrong with that. Nothing wrong with optimism. Just ask Skinny Jack. Or, y'know, Prince.

This ACF exclusive is based on research & analysis originally featured on the author's personal blog - Contravex.com - which has been online and regularly updated for the past 17 years and running. When Pete D. isn't writing, he's managing a successful manufacturing business, raising his young family, and driving his 06 Elise, 16 Cayman GT4, 19 G550, 23 Taycan GTS ST, or soon his 25 GT3 Weissach somewhere in Canada's vast and frozen flyover country. Pete can be reached on X or by email at contravex@gmail.com for all your legitimate complaints about how much of a self-important asshole he is, you'll literally be the first person to ever tell him this and it's like totally going to rock his world when he hears it. Thanks for reading.

You saw the big oaf 5 years ago right? And you saw him in Japan last month? Good, just checking that your eyes still work. As someone who also lost a shit ton of weight back in the day, and has kept 75% of it off since, I appreciate first-hand the effort this kind of transformation takes, and can only imagine that it's wayyyy harder as a 50-something-year-old farmer, or guitarist, or whatever Jack is aside from being a semi-bionic racing driver and auteur.

I'm sure you got the reference, but it's a classic anyways.

Thales of Miletus (624–546 BC) was an Ancient Greek philosopher of whom we know a few insightful stories thanks to Plato’s Theaetetus and Aristotle’s Politics, namely that Thales was a geometrician, astronomer, and generally polymathic philosopher who spent most of his days with his head in the clouds (being mocked by laypeople for his absent-minded detachment) who intermixed his “impractical” musings with quick outbursts of very practical and applied knowledge, such as when he monopolistically leased all his city’s olive oil presses right before an unusually large harvest he’d correctly foreseen but no one else had, which he then turned into a small fortune, as well as when he helped King Croesus of Lydia during a military campaign against the Persians to cross the Halys River by digging an upstream canal to divert part of the river’s flow, thus permitting Croesus’ army to advance through shallower waters.

Pete, thanks for contributing.

If you see this comment, do you have any publicly-shareable thoughts on the life and tragic drowning of your friend, Bitcoin legend Mircea Popescu ?

My investing advice is that if you eat at least two large bacon cheeseburgers a week, you probably don’t need to worry about investing.