Weekly Roundup: Guitar Shows In The Age Of Money Printers Edition

Here's what I should have done with my $778 in 2012: bought 140 bitcoins, which would now be worth about six million dollars.

Here's what I actually did: bought a Gibson Les Paul "BFG Gator".

Today I sold it for $1,079 online. After fees and shipping that's about $980. If you adjust for the official inflation rate I still made about sixty bucks -- but if we've learned anything in the past year, it's that all government statistics are at least partially fabricated, inflation rates most of all.

Why did I sell my Gibson today? Because I listed it on my Reverb store (available here!) and it lasted all of seventeen minutes before selling.

Why did I list it today? Because I just had the most depressing guitar show experience in my life.

Why was it depressing? Let me tell you...

This afternoon I met the fellow who was my guitar teacher from age 12-14, and intermittently since then, at the Ohio Guitar Show in the Columbus-area suburb of Hilliard. In the past few months I've periodically dragged my son over to his house to learn a few songs from someone besides me. Yesterday it was "Eleanor Rigby".

"You've heard this song, right, John?" he asked.

"I have never heard this song," my son replied.

"It's by the Beatles."

"I don't know who that is." I don't know why that shocked me. To begin with, the Beatles are to my son as, uh, let me do the math here, Cab Calloway or Duke Ellington would be to me, in terms of time and distance. Furthermore, I almost never listen to the Beatles so there's no reason John would have heard them. He can reliably tell the difference between Nathan East, Marcus Miller, and Victor Wooten on a record but he has never heard of Paul McCartney. It didn't stop him from picking up the song, and the associated cello riff that opens it, in about fifteen minutes total. In my experience, there are only two kinds of tunes for my son: the ones he can learn in under half an hour, and the ones that exceed his attention span. So Fourplay's "Bali Run" is the former, and Pat Metheny's "Bright Size Life" is the latter; we got about thirty measures in and he flat-out refused to memorize any more of it.

Something else that would exceed his attention span: going to a guitar show. My five-foot-two clone has a remarkable lack of interest in things. Guitars, like bicycles or computers or clothes, are just tools to him. He doesn't care what they look like or what they cost or what their story is. I think back to the things I desperately wanted at his age, like the GT "Pro Performer" Bicycle, a desire so strong I can still physically evoke it in myself by opening an old BMX magazine to the advertisements, and I wonder at his near-total non-attachment. Surely it's my fault, because I get him whatever he wants and because we always emphasize what can be done with something rather than the thing itself -- but maybe "fault" is the wrong word. Desire, as Harriet Wheeler once sang, is a terrible thing.

Unfortunately, as Harriet also sang, I rely on my desire to animate me on a daily basis. I went to the guitar show with the idea of re-animating that desire a bit. Maybe I'd see something I truly wanted. And so my old teacher and I paid ten dollars each and entered the dimly lit convention center with a little bit of hope in our hearts.

Most of what you see at these shows falls into the following categories:

0. Hugely common guitars (Mexican base-model Stratocasters, Les Paul Juniors) sold at Reverb prices plus twenty percent; 1. Utter trash that shouldn't be taking up space on the table (Michael Kelly guitars, random Chinese off-brands); 2. Utter trash from previous eras, like Harmony hollowbody acoustics or Mosrites, listed at eye-watering prices; 3. Fenders and Gibsons from the Seventies priced like they were from the Sixties. A 1972 P-Bass for $8,999? 4. Vaguely interesting and worthwhile instruments (Gibson Les Paul Supremes) that look like they were dropped down someone's basement stairs.

Still, from time to time I'll find something that I can't leave the show without. That wasn't the case this time. I tried to buy a DR-880 drum machine for $180, which would have been a deal, but the seller would only take cash and I didn't have that much. There was a vendor exclusively devoted to genuinely nice bass guitars. They had three examples of the Peavey T-40, all in good shape. I've been thinking about a T-40 for a while; it was what Ross Valory used in the "Escape" era and it has some really outstanding/unique tones. I'd like to get one for my son, because while his hands aren't quite big enough for a 34" scale bass at the moment it won't be long before he gets there.

Here's the problem: the cheapest T-40 at the show was a thousand bucks. These were $500 guitars... not ten years ago, not five years ago, but last year. That's insane, because you can get a brand-new USA-made Fender Precision Bass for a thousand dollars. Except you can't. The base American Performer is now $1,499. The American Professional is $1,749. The American Jaco Pastorius Signature, an example of which I paid $1,300 for a while ago, now sells for $2,049.

This approximate doubling of 2020-era prices isn't limited to guitar shows. It's all over the racing hobby as well. A new set of shock absorbers for my Radical PR6, sorely needed because my existing ones are beyond saving, would cost me ten thousand dollars. I settled for ordering a used set. Prior to COVID-19 I'd been idly eyeing a few 6,000-square-foot homes in my approximate vicinity, but I'd quailed at the idea of paying $650,000 for a house. In 2022, $650k gets you... well, it gets you my existing crib in the slightly nicer neighborhood next door.

Chances are you already know what's happened to used-car prices. They say that's a special case, because the supply of new cars is so tight, but it's also affecting the price of automotive parts, even the ones that have no microchips in them. The Hoosier tires for my Honda Accord race car are now over $500. Each. They have an approximate useful lifespan of sixty to eighty minutes. SCCA entry fees are half again what they were in 2020. Apparently most regions are still losing money on road racing despite the increased cost. In every aspect of my life -- cyclist, auto racer, musician, idiot who buys overpriced crap -- I'm hearing alarm bells about price increases that have happened or are about to happen.

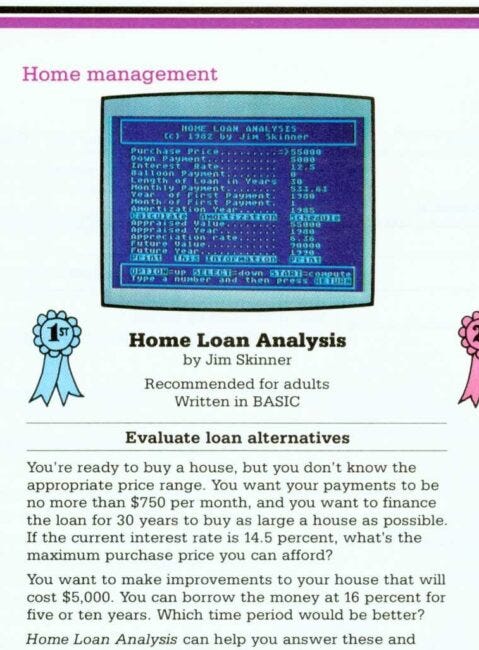

It's obvious to anyone with half a brain that we are squarely back in the Ford/Carter era of rampant inflation. Some of you will recall those days; automakers raised prices four times a year, and General Motors made major hay by subsidizing auto loans at 12.9 percent. Yesterday I was wandering through an Atari computer archive and I found this:

Mortgage rates at 14.5 percent! No wonder my father groaned under the weight of an $88,000 house in 1982. It's just a $550k house now; why, that's hardly a six-fold increase in value! For context, the minimum wage was $3.35 then; it's seven and a half bucks today. No wonder Generation Z doesn't give a shit about outmoded notions of American dreams and private property. Why should they, when it's obvious to all and sundry that they'll never have any of it. A nation of apartment-dwellers doing gig work is not going to vote for anything that preserves the traditional way of life in this country, for the same reason that I don't mail half of my paycheck to the Queen of England.

The difference between 1980 and today? I hate to say it, but my impression of the Carter era, and this might just be my youth and naivete at the time, was that we had serious men in charge of the country. They weren't always right -- far from it. But they were serious and they understood basic concepts of responsibility. Below the serious men who ran the country we had the serious men who ran the states, and the corporations, and the cities, and the villages, and their individual households. Sometimes they ran the institutions under their control into the ground, as was done with General Motors, but you always got the sense that we had adults involved in the process.

When Mr. Biden was placed into office last year, we heard a lot from the media about how "the adults in the room" were back in charge. And yet what happened afterwards would be more or less what you'd expect if you took the country out of the hands of adults and gave it into the power of petulant children. The government has been feckless in every aspect, from monetary policy to COVID-19. Other than warning Americans that the insufficiently vaccinated face a "winter of severe illness and death", a bizarre ejaculation that had no tangible correlation to the facts on the ground then or now, Mr. Biden's primary pandemic actions have been an unconstitutional attempt to force vaccine mandates by proxy and a recent admission that this disease will need to be handled at the state level. One cannot help but feel that Mr. Trump would have been better for the economy, and that a 200-pound sandbag placed on the seat in the Oval Office would have been better still.

We've been told that the annual inflation rate is hovering between five and seven percent, but that's an obvious lie that would exceed the ability of the Iraqi Information Minister to repeat without laughing; I don't know anyone who thinks that the real-world year-over-year rate from 2020 to 2021 was less than fifteen percent. Twenty or thirty percent seems like a safer bet. That's certainly where the asset prices are going. The cynical among us could see this as a final push to make sure the Boomers stay wealthy until the end of their time on Earth; in a world where the Fed keeps the rate so low that you can literally get rich borrowing money to buy any tangible asset whatsoever, the Boomers' remarkable hold on those assets will keep them in cash for quite some time.

Certainly it amounts to yet another squeeze on the middle class. Transfer payments will rise with inflation, of course, and the assets of the fabled One Percent will appreciate ahead of the inflation rate, but those of us who are drawing a salary in the middle will likely see an effective pay cut every year from now until who knows when. How long until the rest of us just give up, sell our homes to Blackrock, and fall headlong into the transfer-payments demographic?

I'll tell you what people are not doing: they're not selling their guitars. As with cars, it seems like a better idea to hold onto what you have rather than to overpay for something new. The owner of Cream City Music, a great Wisconsin shop that sold me a few nice Godin synthaxes a decade ago, was standing forlorn at an empty table, trying to buy guitars from the people who came into the show. After six hours at said table, he had a total of seven cases stacked up next to him, and an unspent stack of hundred-dollar bills perhaps four inches deep in his pocket. "Not what I expected," he told me. A young man with a vintage Kramer bass showed up; one of the ones with a laminated body. "I need eight hundred bucks," he said.

"Seven," the Cream City man said.

"It's gotta be eight," he replied.

"What the hell, let's do it, I'm gonna leave here with an empty van at this rate, so I need to buy." Eight hundred-dollar bills were peeled off. Last year that was suicide money for a Kramer bass. Now? The cheapest laminated-body model on Reverb is listed at $1,615. It's an eight hundred mile roundtrip from Milwaukee to here, but you don't need too many deals like that to make your time worthwhile, the same way CarMax would happily pay me $25k for my Lincoln MKT because there's a buyer waiting to pay $30k.

"You wanna give me nine grand for my Gibson R9?" I asked him.

"Go home and get it," he replied. So I went home, but rather than return with my Lester I reopened my Reverb shop and listed three guitars at slightly unreasonable prices. Seventeen minutes later, I was down to two guitars. Judging by the amount of people who have looked at the other two listings, I don't think they'll last very long, either. My first impulse: take that money and buy a Peavey T-40. Second, and lasting, impulse: hold on to the money. But not too long, because it's shedding value as I hold it, Weimar-style.

That's the strangest thing about our superheated, underpowered economy: clearly the smart move is to sell everything you own and put the money into stable assets. Except: if the interest rate goes back up, and it seems set to do just that, the prices of everything will sink. Or will they? If Blackrock is buying all the homes (there's not a single completed house for sale in my zip code) and they're playing with house money, why would they stop?

In the meantime, I'm going to stay away from the guitar shows. I recommend you do the same. As is always the case, I have quite a few very special instruments stashed away and I'll cheerfully make one available under market price for a Riverside Green reader. Feel free to take twenty percent off any Reverb listing of mine you see, or inquire about what you don't. In particular, I have two very nice PRS Modern Eagles, one with a Brazilian rosewood neck and the other with an Indian rosewood neck. Worst case scenario, you buy one and sell it for more in five years. Or is that the best case scenario? What does it say about us if we can't decide?

* * *

For Hagerty, I discussed open-source EVs and reviewed a truly strange Mitsubishi.