The Big Bang Gets Cheaper, But I Wouldn't Buy Just Yet. Or Ever.

Half prices on Big Bangs? Is this the beginning of the off-brand Swiss watch price implosion? Warning: wandering topics ahead.

One of the aspects of modern industrial life that I find most interesting is the idea of the unreal showroom price. What I mean by that is this: there are many products which have a price in the secondary market that is closely related to their new price. Take a Honda Civic as an example. A used Honda Civic is worth a certain fraction of the price of a new Honda Civic and that fraction is determined by age and the depreciation curve is very easy to comprehend. The same is true for most products that have a known commercial function. A 3/4-ton van depreciates in an easy to predict fashion, because there is some enterprise of some sort that can use it right up to the time when it goes to the junkyard and has a scrap value.

If you buy a new Rolex of a certain type, like a Milgauss, you can have a fair idea of what it will be worth in the years to come. If you go to sell it, you can deduct the dealer profit margin from the typical used price and there you go. In that respect, it's like a Civic. There is a market for used Civics, and it is strong.

On the other hand, there was a guy on reddit recently who had paid about four grand for a Cartier Tank Francaise at a Cartier shop and then found himself in a position where he needed to sell it. The highest price he was offered at a dealer was... wait for it... eight hundred dollars. Given that there's one on eBay that was a no-sale at $1,750 --- under half of retail for a like-new product --- I think that eight Benjis was, in fact, probably all the money.

Think about this for a moment. If eight hundred bucks is all you can get for a Cartier Tank, that's the true value of a Cartier Tank. A used one in like-new condition, anyway. So why would anybody pay the extra thirty-two hundred dollars for one?

There are some reasons --- the primary one being that you're unlikely to accidentally buy a fake Cartier if you walk into a Cartier store and buy one there --- but I'd suggest that what's really happening is that there are simply two kinds of people in this world: people who will buy product X used or new and people who will only buy it new.

That varies by what product X is, of course. Nobody will pay anything for a used condom and very few people would buy a new condom from anywhere besides a pharmacy/grocery store/other reputable source. On the far side of that, people will buy "Crocs" from street vendors. The market for used Rolls-Royces is problematic because the majority of potential Rolls-Royce buyers can afford to buy them new and would rather do without the trouble. The market for used Toyota Corollas is white-hot because it's a known reliable transportation item and as a consequence I'm personally aware of people who paid more for a year-old Corolla than they would have paid for a new one were they willing to do a bit of negotiation.

I stopped buying new guitars in any quantity a while ago. I realized that I was competent to determine whether a used guitar was in acceptable condition and also that I had no interest in paying the new-guitar premium for something that I might not play that much before reselling to someone else. As a child, however, I very specifically did not want a used guitar and most of my reasons for my stance on the matter were emotional. I'd suggest that a lot of purchases that take place at a Cartier store are entirely emotional in nature, which is why there's one near every major casino.

Had there been a really great Les Paul Custom like Jimmy Page's Black Beauty available at a rock-bottom price, however, I might have changed my mind. If the used price of like-new stock drops far enough, there will be consequences in the market, even if most of the purchases of that item are highly emotional.

And now we come to the part where I admit that I bought my first (and only) wife's engagement ring at a pawnshop. We were flat broke and we wanted a ring and I had read extensively on the actual (which is to say, secondary-market) value of diamonds and I was disinclined to go into debt for something that was effectively worthless. So we paid $249 for a quarter-carat diamond ring set with small-chip diamond surrounds. The same thing was going for $1200 or so at the big jewelry stores. With the money we saved, we significantly improved our honeymoon trip.

Amazingly enough, nobody ever asked us if we got the ring at a pawnshop. (And my wife eventually asked me to stop telling people.) It turns out that the circumstances under which you buy something are utterly meaningless to your long-term utility with that "something", no matter what it is. That single lesson has saved me hundreds of thousands of dollars in my life. It stuck with us. A decade after that ring, my wife saw an amazingly expensive diamond and rainbow sapphire bracelet at a jewelry store.

"I want it," she breathed.

"You can have it," I replied, because it was a time in my life where I had more money than I knew what to do with. (See also: owning two Phaetons for no reason.)

"Okay," she said. And she turned and walked out the door, and a month later a rainbow sapphire bracelet appeared in the mail that looked identical to the one she'd originally liked. It cost us half as much. I think she still has it, which cheers me. She valued the money saved, which was substantial, over the rush of buying something the minute you see it.

When I got my Hour Vision, I did the same thing: saw it in a Vegas boutique, decided to get it, started shopping for one, saved a couple thousand dollars by being able to wait ten days for it. And it's the same watch I'd have gotten from Miss Ling Huang, the beautiful Chinese woman at the Omega boutique whom I'd recommend to anyone with enough disposable income to buy stuff like that on a whim. By the way, I wore it for my races this weekend and really enjoyed it:

Anyway. Back to Hublot. (This blog has no editor besides me. Can you tell?) The Big Bang has been overpriced from the jump. It's been a fashion watch selling on fashion. The mechanicals of it are close to worthless and the brand is iffy and the design of the watch has Star Wars 1977 Quartz LED Of The Future written all over it. Unlike a Rolex or Omega or even an IWC, there is little intrinsic value to the thing.

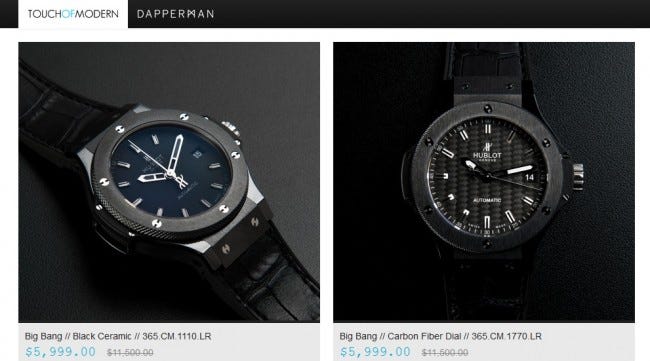

As a consequence, eBay is full of no-sales at half retail price. Which means that eventually the massive weight of the thousands of unsellable Big Bangs will start to drag on the new-watch market. Thus the TouchOfModern half-price sale. Plenty of Big Bangs left at half price, even after a long sale period. Do you think that Omega Speedmasters or Rolex Daytonas would stay unsold at half price for a week or two? Of course not.

If you want a Big Bang, now is still not the time to buy. Wait another two or three years. There's probably no floor to the value of them. The 20% of retained value experienced by our Redditor with the Tank Francaise is probably about right for transaction prices of 2018 and beyond. The question is: does this mean that the era of the quick-bake Swiss-watch reboot is over? Or has the Big Bang just fallen too far out of fashion?

I'd say it's a little of both. As the economy continues to not recover, more and more people will think twice about buying a twelve thousand dollar status statement. Even at half price. Or less. Nobody tell this guy, though. (Or this dude, with his quartz-ticking Fublot.) It's bad enough to brag about having a fake watch that people want, right?